Home / Case Study / From Valuation Woes to Investment Wins in Massachusetts

63%

Loan to Value

$355,950

Total Loan

Ben

Shrara

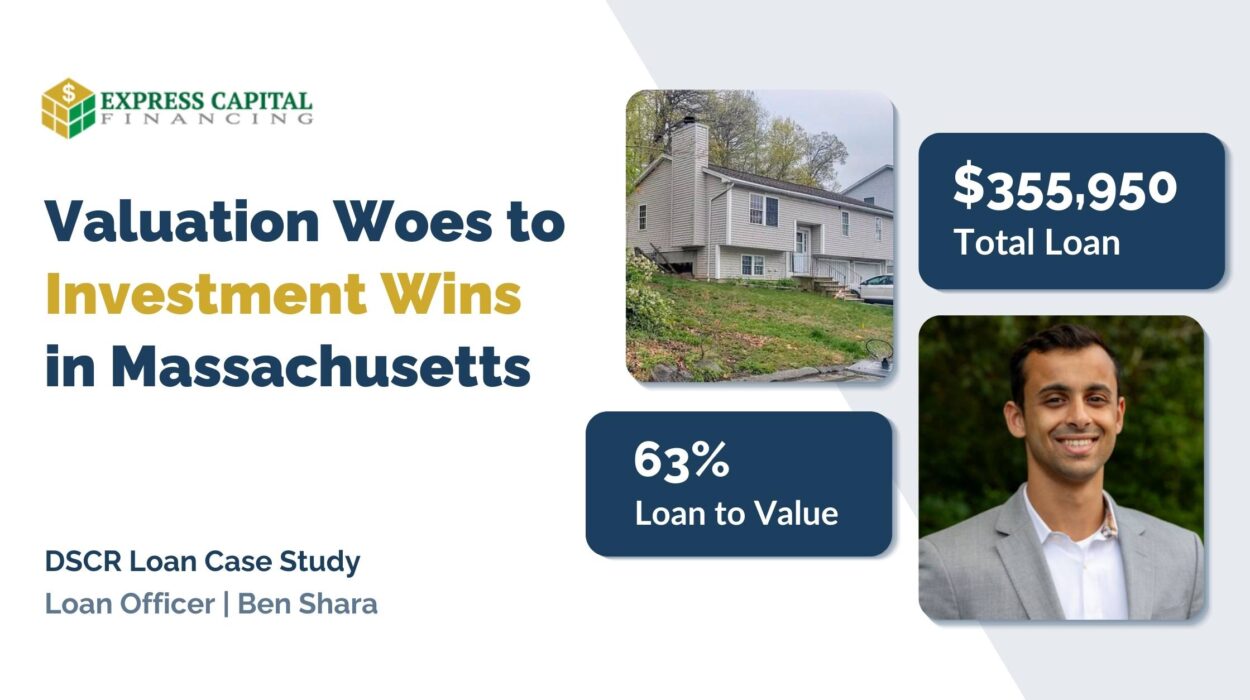

From Valuation Woes to Investment Wins in Massachusetts

Case Study I DSCR

Navigating through undervalued appraisals and looming loan maturities, a strategic refinancing solution turned a precarious property investment into a success story.

63%

Loan to Value

$355,950

Total Loan

Ben

Shrara

The Stats

$355,950

Total Loan Amount

7%

Interest Rate

63%

Loan To Value

1.267

DSCR

The Stats

$355,950

Total Loan

Amount

7%

Interest

Rate

63%

Loan To

Value

1.267%

DSCR

Overview

Loan Program Used

DSCR

Closing Date

November 5th, 2024

Location

Worcester, MA

Property Type

Single Family

Goals

Achieve timely cash-out refinancing by effectively managing low appraisals and imminent loan maturity with targeted value and debt service improvements.

Home / Case Study / From Valuation Woes to Investment Wins in Massachusetts

3 min read

Project Summary

Confronted with a property that failed to meet debt obligations and faced a devalued appraisal, Ben Shrara and the Express Capital Financing team acted quickly, devising a personalized strategy that recalibrated the asset's worth and enhanced the debt service coverage ratio.

Their timely and expert approach not only ensured the client could pay off the existing loan and achieve the desired refinance but also affirmed the strength of the client's long-term investment plan.

The Challenge

The immediate obstacle was the property's failure to service its existing debt as expected, compounded by an appraisal that undervalued the fair market rent. This valuation issue directly impacted the debt service coverage ratio (DSCR), an essential metric for securing refinancing, and was further impacted by an approaching deadline for the current loan's maturity, putting the investor in a precarious position.

● Suboptimal Debt Servicing: Initially, the property did not meet the debt service coverage ratio (DSCR), a critical financial metric for securing refinancing, casting doubt on the feasibility of the project.

● Low Fair Market Rent Appraisal: The property's appraisal revealed a lower-than-expected fair market rent, further complicating the refinancing process by undermining the property's income-generating potential.

● Urgent Closing Deadline: Complicating matters was the tight timeline necessitated by the looming maturity date of the current loan, introducing a critical deadline that required swift action.

The Solution

Ben Shrara and the Express Capital Financing team swiftly employed a highly customized approach to tackle these challenges head-on. Recognizing the tight deadline, they expedited the processing and immediately submitted comparable property analyses to adjust the 'as is' value of the property. This strategic move lowered the leverage to the property's value, which in turn significantly improved the debt service coverage and decreased the applicable interest rate.

By crafting a tailor-made financial strategy, Ben Shrara ensured that leverage needs were satisfied without compromising investment objectives.

Key Takeaways

- Personalized Financing Solutions: Ben’s ability to craft and implement customized financial strategies plays a pivotal role in overcoming investment obstacles.

- Responsiveness and Speed: Quick submission of comparables coupled with timely service interactions can make or break the success of time-sensitive deals.

- Expertise Matters: Working with a lender who brings a wealth of experience and a flexible, creative mindset to the table is invaluable.

- Strategic Partnerships: Aligning with a lending partner like Express Capital Financing, who puts the investor’s goals at the forefront, proves to be a significant factor in achieving financial success.

Overcome, Optimize, Outperform with Express Capital Financing

Whether it’s overcoming a devalued appraisal or optimizing your debt service coverage ratio, partnering with us means accessing tailor-made strategies that not only meet but exceed your investment needs. Embrace the opportunity to transform challenges into victories and secure your investment’s future with the expert guidance and personalized attention of Ben Shrara and the Express Capital Financing team. Don’t let another moment pass—Contact us today for a DSCR loan that drives your project to success.

Featured Topics

Overview

Loan Program Used

DSCR

Closing Date

November 5th, 2024

Location

Worcester, MA

Property Type

Single Family

Goals

Achieve timely cash-out refinancing by effectively managing low appraisals and imminent loan maturity with targeted value and debt service improvements.

Related Success Stories

Breaking Ground and Shattering Norms with a Contractor’s Vision

Discover how a visionary investor, faced with daunting financing roadblocks, unlocked the secret to transforming…

Realizing Real Estate Dreams: An Engineer, a Loan Officer, and a Turning Point

From grappling with a disappointing appraisal to executing a strategic pivot from flipping to holding,…

From Low Appraisal to High Reward in a Profitable Flip

When a surprisingly low property appraisal threatened to derail a major investment, clever financing solutions…

Apply for Financing

Take that first step toward fast and reliable funding by completing a short form and applying for financing.

Talk to a Loan Officer

Connect with an expert for personalized guidance. Let's discuss your financial goals and chart a path to success.